Reach out for a copy of this report or for a custom research report. Email Me: ravisingh@digitalpresence.co.in

Market Overview: Australian Car Wash Industry

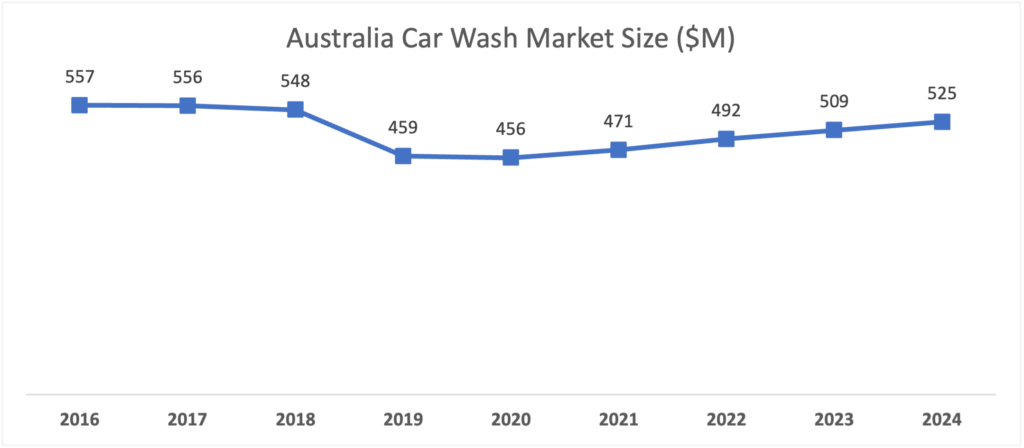

The Car Wash and detailing services market is a US$471M market, and it is expected to grow at a CAGR of 2.7% post covid (2021 – 22 onwards), reaching US$525M by 2025. Currently, the market is witnessing a decline due to adverse economic conditions related to the COVID-19 outbreak, and the revenue declined by 16.4% as projected in 2021. Falling discretionary incomes (due to job loss) and a decline in average weekly hours worked have also contributed to the industry’s poor performance. These trends have encouraged more consumers to save money and wash their vehicles at home. However, increased consumer environmental awareness regarding the high-water consumption and potential pollution caused by washing vehicles at home has supported demand for industry services over the period.

In terms of segments, self-service bay and in-bay automatic Car Wash are the most popular ones in Australia. The household with the highest income quintile and the private sector is the most active end users.

Several macro factors will also drive the industry growth in the next few years. These factors include the total number of motor vehicles, the average age of these vehicles, real household discretionary income, water availability, etc. Unlike Australia, the US and European Car Wash industries are way bigger. Per an estimate, the US Car Wash industry is 20 times that of Australia and is worth US$10B. Both Europe and the US also employ way more people compared to Australia. Per a report by IBIS, Both Europe and the US generate 30 times more employment compared to Australia.

The market for Car Wash in Australia is highly fragmented, with no major player dominating the same. Magic hand Car Wash, BP Australia, and Coles group are the key vendors.

Market Size

Revenue for the Car Wash and Detailing Services industry in Australia is expected to decline at a rate of 2.4% over the five years through 2020-21, to US$456M. This decline can largely be attributed to the COVID-19 pandemic, as restrictions on movement, gatherings, and economic disruption are anticipated to constrain industry demand. Falling discretionary incomes and a decline in average weekly hours worked have also contributed to the industry’s performance over the past five years. These trends have encouraged more consumers to save money and wash their vehicles at home. However, increased consumer environmental awareness regarding the high-water consumption and potential pollution caused by washing vehicles at home has supported demand for industry services.

The market is anticipated to pick up from 2021 – 22 onwards, growing at a CAGR of 2.7%, reaching US$525M by 2025. Rising discretionary incomes are expected to drive industry revenue growth over the period. However, increased urbanization trends are projected to limit industry growth as more consumers reduce car travel in favor of public transport. Industry automation is forecast to increase over the next five years, with in-bay automatic washes and conveyor tunnel washes becoming more popular with consumers. This trend is anticipated to support a rise in industry profitability.

As per IBIS, the market is fragmented, with 1.8K+ businesses employing 3.5K people. The average profit margin in this business is 7.2% in 2020. This has declined from 8.6% in 2015. 43% of car owners in Australia regularly use commercial Car Wash es

Contact me for the complete report: ravisingh@digitalpresence.co.in

Table of Content

- Industry Definition

- Main Activities

- Summary

- Market Size

- Market Size by products and services segmentation.

- Market by geography

- Market Size by end-users

- Cost Structure Benchmarks

- Profit

- Purchases

- Wages

- Rent and utilities

- Supply Chain

- Trends

- Business Trends

- Technology Trends

- Key Success Factors

- Macro Growth Drivers

- Number of Motor Vehicles

- Real household discretionary income

- Availability of water

- Average weekly hours worked

- Average age of vehicle fleet

- Demographics and Future Growth Projection

- Car Buyers: Emerging Groups

- Barriers

- Customers Demographics and Behavior

- Market Comparison: Australia Vs. Other Geographies

- US Car Wash industry overview

- Car Wash centers by segment

- Customer Comparison: Australia Vs. Other Geographies

- Opportunity

- Price Satisfaction

- Age of Vehicle

- SWOT Analysis

- Competitor Landscape

- Competitors

- Magic hand Car Wash franchisor

- BP Australia investments

- Coles Group Limited

- Mpower Franchising

Reach out for a copy of this report or for a custom research report. Email Me: ravisingh@digitalpresence.co.in

Leave A Comment